22 Dec 2025 | By YGG

Introduction: Can One Standard Bridge a “Trust Gap” Across the Pacific?

For a long time, international buyers, particularly brand owners in North America and Europe, have faced a classic dilemma when evaluating Chinese plant extract suppliers: How to efficiently identify the “reliable partners” whose production systems, quality control, and documentation management truly meet the requirements of major international markets from a sea of suppliers? On one side are the “China GMP” or “ISO certifications” that Chinese suppliers pride themselves on; on the other are the systems more familiar to international buyers, such as the U.S. “cGMP for Dietary Supplements” (21 CFR Part 111) or the EU’s “GDP.” The significant differences in language, detail, and focus between these systems create substantial verification costs, communication barriers, and hidden risks.

The release of the “Good Extraction Practice (GEP)” group standard and the launch of the Sino-US joint certification program in June 2025 aim to address this core pain point directly. This is not merely a technical specification but a strategic co-construction of industrial infrastructure. It seeks to build a clear, reliable, and mutually recognized bridge between the different quality discourse systems of the East and the West.

Chapter 1: The Birth of GEP—The Inevitability of Industrial Upgrade and a Reflection of Major Power Dynamics

1.1 Endogenous Demand: The Inflection Point from “Scale Expansion” to “Value Recognition”

After decades of development, China’s plant extract industry has established global advantages in capacity, cost, and technological breadth. However, labels such as “large but not strong” and “high volume, low price” persist. The deep-seated need for industrial upgrading is to shift from “supplying commodities” to “supplying trust and solutions.” The emergence of GEP provides a leading and ambitious benchmark for top-tier and upgrading companies to differentiate themselves from low-price competition and demonstrate systematic capabilities. It signifies that industry competition is evolving from singular metrics like price and technical specifications towards comprehensive systems competition encompassing full-process quality management, traceability, and continuous improvement capabilities.

1.2 External Drivers: The “Trust Efficiency” Race Amid Global Supply Chain Restructuring

Against the backdrop of geopolitical shifts and “China Plus One” supply chain strategies, international buyers’ demands for transparency, resilience, and compliance certainty have reached an all-time high. The traditional model of multiple audit rounds and lengthy factory inspections is costly and inefficient. A standard jointly endorsed and with mutually recognized content by authoritative institutions from China and the US (China National Institute of Standardization, China Chamber of Commerce for Import & Export of Medicines & Health Products, and the U.S. UNPA) can significantly streamline due diligence processes and reduce transaction costs for both parties. In essence, GEP is a “trust accelerator” jointly created by Chinese and American industries to enhance bilateral trade efficiency and hedge against uncertainty risks.

Chapter 2: Deconstructing the Core of GEP—Beyond Production, a Reshaping of Management Systems

GEP is not a simple repetition or translation of existing GMPs but a more targeted and advanced industry-specific standard. Its depth is reflected in the following dimensions:

2.1 Full Lifecycle Management

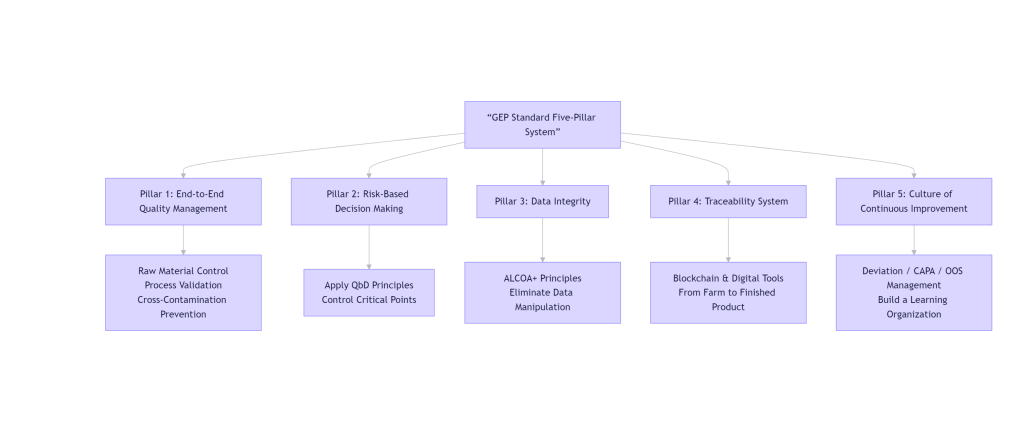

The GEP standard system covers the entire lifecycle of plant extracts from “cultivation/procurement to finished product release.” Its core framework can be summarized by five key pillars, visualized below:

This system extends quality management from the traditional production floor backwards to the farmland and forwards to storage and logistics, achieving genuine end-to-end control.

2.2 Distinctive Risk Control and Science-Based Orientation

Integration of “Quality by Design (QbD)” Philosophy: GEP encourages a systematic understanding of the relationship between raw material attributes, process parameters, and product quality during the process development stage, defining critical control points (CQAs/CPPs), rather than relying solely on final product testing.

Extreme Emphasis on Data Integrity: The standard addresses a chronic industry ailment by strictly requiring that the entire process of data generation, recording, modification, storage, and destruction complies with the ALCOA+ principles (Attributable, Legible, Contemporaneous, Original, Accurate, plus Complete, Consistent, Enduring, Available). This implies that a compliant Laboratory Information Management System (LIMS) and electronic batch records are almost prerequisites for certification.

The Ultimate Inquiry into “Authenticity”: GEP sets verifiable, specific requirements for the species identification of raw materials (e.g., DNA barcoding), origin traceability, and pesticide residue/heavy metal profiles, aiming to systematically address long-standing industry risks of adulteration and contamination.

2.3 Comparison and Advancement Over Existing Standards

| Dimension | China Drug GMP / Food SC Permit | U.S. cGMP for Dietary Supplements (21 CFR 111) | GEP (Good Extraction Practice) |

| Core Positioning | Basic requirements for general drug/food production safety | Regulatory requirements for finished dietary supplement production & packaging | A quality management system standard exclusive to plant extracts, covering the entire chain |

| Starting Point of Focus | Incoming raw materials | Finished product manufacturing | Raw material cultivation/wild collection, primary processing |

| Technical Specificity | General | General (focus on dosage form production) | Highly targeted at unit operations like extraction, separation, purification, drying |

| Mutual Recognition Value | Domestic regulatory recognition | Foundation for US FDA compliance | Jointly promoted by Chinese & US industry bodies, aiming for international (especially US market) supply chain mutual recognition |

In short, GEP is the industry’s upgraded answer—“more focused, more upstream, and with greater mutual recognition value.”

Chapter 3: The Industry Shockwave—Cleavage and Restructuring of the Value Chain

The implementation of GEP will inevitably subject all links of the industrial chain to a “stress test” and a re-evaluation of value.

3.1 For Suppliers: Accelerated Differentiation, Defining the “New Premium”

“Moat” for Leading Enterprises: For leading companies with a solid foundation, GEP certification serves as an authoritative “diploma” of their comprehensive strength, helping them connect directly with high-end clients, obtain brand premiums and long-term orders, forming a Matthew effect where the strong get stronger.

The “Survival Line” for SMEs: The investment required for certification in areas like traceability systems, digital transformation, and documentation management presents a significant barrier. Companies unable to meet the standard will be squeezed into the low-end market or transform into raw material suppliers for certified companies, leading to increased industry concentration.

Transforming “Compliance Cost” into “Competitive Asset”: The marketing narrative of leading suppliers will shift from “we are cheap” to “we are transparent, traceable, and systemically reliable,” with the focus moving towards showcasing the quality story behind their GEP certification.

3.2 For International Buyers: Transformation of Decision-Making Paradigms and Risk Models

Audit Efficiency Revolution: Primary supplier screening can be simplified to “GEP certification status.” On-site audits can shift from basic compliance checks to deeper assessments of technical capability, R&D collaboration, and sustainability, transforming the relationship from “regulator-regulated” to “partners in co-development.”

Risk Pricing Restructuring: The risk premium associated with the supply chain decreases. Partnering with GEP-certified suppliers significantly reduces the risk of product recalls, litigation, and brand reputation damage due to quality fluctuations or compliance issues, which should carry greater weight in the Total Cost of Ownership (TCO) model.

Redrawing the Supply Chain Map: Procurement strategies can quickly build a high-credibility “core supplier pool” based on the GEP certification network, optimizing global sourcing布局.

3.3 For the Industrial Ecosystem: Driving Dual Transformation—Digitalization and Greening

Digitalization Becomes a Mandate: Meeting GEP’s requirements for full-chain traceability and data integrity will inevitably force the widespread adoption of IoT sensors, blockchain, cloud computing, and AI data analysis, thereby driving the digital transformation of the entire industry.

Integration of Green Sustainability: The standard’s focus on solvent management, energy consumption, and waste handling will push companies to deeply integrate Environmental, Social, and Governance (ESG) factors into their core operations to meet the sustainability requirements of global brands.

Chapter 4: Strategic Action Guide—Navigating the Wave of Standardization

4.1 Roadmap for Chinese Suppliers

Gap Analysis and Strategic Decision: Immediately conduct a rigorous self-assessment against the GEP standard. Top management must decide: invest resources to become a “first-wave certifier” and establish a benchmark position, or settle for being a supporting player in the supply chain?

Invest in “Digital Infrastructure”: Prioritize planning and investment in LIMS, MES (Manufacturing Execution Systems), and traceability platforms. This is the technical foundation for certification and the basis for future efficiency gains.

Talent and Cultural Reshaping: Systematically train employees, especially in quality and production management, to understand the risk-based thinking and data integrity culture behind GEP. Drive the company’s shift from “experience-driven” to “process and data-driven.”

4.2 Optimized Procurement Checklist for International Buyers

Update the Supplier Scorecard: Set “GEP Certification Status and Level” as the highest-weighted prerequisite. Add checks for the authenticity of upstream traceability data, the effectiveness of data management systems, and the rigor of change control procedures to the audit checklist.

Engage in “Pre-Certification” Collaboration: For strategically promising non-certified suppliers, consider providing technical guidance or signing long-term letters of intent with certification timelines to secure future capacity at favorable costs.

Leverage Certification to Deepen Collaboration: Explore deeper collaboration models with GEP-certified suppliers, such as co-branding, exclusive formula development, and shared intellectual property, transforming supply chain advantages into market advantages for end products.

Conclusion: Towards a “Common Language” Era for the Global Botanical Supply Chain

The profound significance of the GEP standard transcends a single technical specification. It is a “common language of quality” and a “trust operating system” co-developed by China’s plant extract industry at a critical juncture in its climb up the global value chain, together with its most important international markets and industry organizations.

Its successful implementation will gradually dissolve the “trust tax” between buyers and sellers, allowing business cooperation to focus more on innovation, efficiency, and value creation itself. For China’s industry, this is a key leap from being the “world’s factory” towards becoming the “world’s quality hub.” For the global market, it means a more stable, transparent, and efficient supply chain for plant-based ingredients is becoming a reality.

Ultimately, GEP is not just about how to produce an extract; it is about how to establish a new, sustainable order of cooperation in the globalized botanical health industry—one based on shared rules and mutual understanding. This is perhaps the deepest industrial aspiration carried by this standard.